Investors already want to be ahead of the next predicted stock market crash. New investors can feel especially nervous about what is on the horizon for the markets. Nobody wants to buy into stocks, only to see them go to zero.

When you start investing it can really feel like you don’t know what on earth you are doing. You second guess yourself and you worry that you’re about to make a huge mistake. It might feel like you really don’t have enough information about the stock market, current economic trends, or knowledge of stocks to invest.

Disclaimer: This is not investing advice. You are responsible for your own investing decisions. When investing capital is at risk. This article may contain affiliate links.

Andrew | Mr Money Side Up

We’re often led to believe that investing requires a tremendous amount of knowledge or insight. You might feel you need to have the brain of a supercomputer to be a successful investor. Our perception of a successful investor is usually something along the lines of Bradley Cooper in Limitless, day trading with his four screens, twirling his pen, surrounded by a crowd of spectators (a film I’d definitely recommend you watch!).

You could be forgiven for feeling like you don’t have the strategic insight required for investing. This is probably what holds the majority of people back when it comes to investing and I’ve often been told things like, “I don’t know anything about stocks”, “I wouldn’t know who to invest in”.

The Investing Expertise Myth

It’s not your fault if you do feel this way, it’s a myth perpetuated by institutions and individuals around the world; for the simple reason that they want to charge you high fees for their insight. The reality is that you only need a very limited understanding of investing principles (e.g. what a ‘stock’ is), to actually beat many of these experts. In fact, there is a very simple investing strategy that would have allowed you to outperform 90% of the ‘experts.

In reality, the traits of a successful investor are far different from what you might think. Some of the most successful investors in the world assign credit to behaviours at the other end of the spectrum to what you usually see in everyday media coverage.

#1 Attitude Is More Important Than Knowledge When Investing

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas”.

Paul Samuelson

The Excitement Of Day Trading

You’ll always see a bunch of ads circulating on TV or Youtube for things like Plus 500, Etoro of Trading 212. They’ll show you convaluded charts, complex software, algorithms to encourage you towards the excitement of day trading. The sad thing is 80% of day traders lose money. One study even found that only 3% of Brazilian day traders actually made any money at. Another study paints an even darker picture with less than 1% of the day trader population able to predictably and reliably earn positive returns.

Platforms like Robinhood are only making the situation worse, by causing “extreme herding events”. This is where inexperienced investors crowd into a very disproportionate amount of stocks causing large price spikes, this is known as attention-induced trading. These generally will not end well, because the earnings simply won’t match up to the valuation. This will cause many newbie investors to lose money. The anecdotes of people being burned by stocks usually spread and scare would-be investors away from the stock market.

Hyper Fixation On Individual Stocks

Therefore, chasing the money and being hyper focused on individual stocks cause most investors to lose money. By contrast, taking a relaxed attitude and doing next to nothing is actually a decent strategy. One of the biggest things you can bring to the table when it comes to investing is patience. This is because once you decide on a wealth manager and investment strategy, there’s very little you can actually do.

All you can actually do is watch that recurring payment go out every month, occasionally check your portfolio. At a push, maybe you’ll re-evaluate your budget to see if you can invest any extra money. Then you repeat this cycle for the next 20 years or so on.

That’s literally all there is to it.

#2 Your Tolerance To Volatility Matters Most

“If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks.”

John Bogle

John Bogle was actually being pretty generous when he said a 20% loss. A loss of between 10% to 19.9% would usually be considered stock market correction and these occur once every 1.87 years.

A bear market is anything over a 20% drop from a recent high and there have been 10 bear markets since 1950. This means they have hit once every seven years, on average, with losses of up to 57%.

If you go as far back as 1929 there have been 26 bear markets with losses of up to 61%; with an average loss of 36%. Therefore, you can probably add an extra 16% of losses to John Bogle’s quote.Historically, the average bear market is usually 9.6 months. However, you may have had to put up with your losses for up to 17 months.

How Long Will The Next Predicted Market Crash Last For?

Interestingly, the faster a market index enters into a bear market, the shorter they tend to be. A market index is a hypothetical portfolio of investment holdings that represents a segment of the financial market. The calculation of the index value comes from the prices of the underlying holdings. An example of a market index is the S&P 500 which is formed of the top 500 large-cap stocks in the US.

Historically, stocks take 270 days to fall into a bear market. When the S&P 500 has fallen 20% at a faster clip, the index has averaged a loss of 26%. The covid-19 crash fell into a bear market in just 33 days. This might explain why, by March 2021, the Dow Jones, S&P 500 and Nasdaq had soared 76, 76 and 95 percent, respectively, making the past 12 months one of the best 365-day stretches since World War II.

The stock market crashes when fear hits the world. At the start of covid-19 nobody knew how intense the virus would be, how long it would last for or how the world would react. Fear often researches its peak when people have no rational way to predict future events. This is precisley what happened on March 23 2020 and caused a stock market crash.

However, the people who did not panic sell their investments over this 12 month period, are the same people who will have benefited from the 95% increase. This highlights how you react to volatility can make the crucial difference between your portfolio’s performance.

#3 Why Patience Is As Important As Strategy

The Stock Market is designed to transfer money from the Active to the Patient.

Warren Buffett

It’s not only your stoic attitude to volatility that matters. It’s your ability to remain patient and keep investing over an incredibly long period of time. You might be surprised to hear that Warren Buffet, of the world’s wealthiest people, actually accrued the vast majority of his wealth after the age of 65. This is traditionally when most people retire.

The reason for this isn’t just his investing prowess, it’s because of the time he allowed his returns to compound.

Hear me out.

Jim Simmons Vs Warren Buffett

Jim Simmons is 83 and founder of the hedge fund Renaissance Technologies (quantitative hedge fund), has compounded money at 66% annually since 1988.

Warren Buffett by contrast, compounded at roughly 22% annually, a third as much. However, Simons’ net worth (as of July 2021), was around $24.6 billion.

Although Buffett’s younger by 7 years and also 75% less rich than Buffett; and that’s including the fact that Buffett has donated 37.4 billion to charity vs Simon’s $2.7 billion.

The sole reason for the massive difference in net worth is because Simon’s didn’t get into his investing stride until he was 50, by contrast Buffet has 70 years to compound this wealth.

If Simons had earned his annual 66% return for the same 70 year span as Buffett, his wealth would be worth: $63,900,781,780,748,160,000.

That number doesn’t even compute in my head. For those of you also struggling, that’s:

sixty-three quintillion,

nine hundred quadrillion,

seven hundred eighty-one trillion,

seven hundred eighty billion,

seven hundred forty-eight million,

one hundred sixty thousand.

#4 The Law Of Averages Supersedes The Most Common And Rarest Events

“The four most expensive words in the English language are, ‘This time it’s different.”

-Sir John Templeton

People always react to even very mild events with knee-jerk reactions. In any given week there will be numerous news articles suggesting there will be a market downturn because of things like interest rate rises. Many see the slightest signal as a prelude to the next predicted market crash.

The markets react with their usual volatility and then after a day or two, investors find a reason to not be so pessimistic. After selling their stocks they buy more. If I had a pound for everytime this happened I would be as rich as Jim Simmons.

…The Next Major Predicted Market Crash?

I often ask myself quetion such as will the stock market crash again and what happens if our trusty S&P 500 index crashes like the Japanese Nikkei. What should we do and how can we prepare ahead of the next predicted market crash.

When it comes to a situation perceived to be catastrophic in nature (see above graph), most traders have an absolute meltdown. Even the average investor will get the wobbles and despite having seen other market crashes on paper, will think that “this time is different”.

You might think that Covid-19 would have devastated the stock market. However, the markets have repeatedly reached all-time highs. Yes the last couple of years have been very different, but so was every other climate surrounding the other bear markets for the past 100 years.

In short, despite all of this volatility, and constant bear market signals (the latest being the inflation rate), bull markets tend to last on average 2.7 years. The longest bull market lasted from 2009 to 2020. However, given the fear of the Great Recession, it’s more than likely most investors would have fled the stock market, or never even started. As a result they would have missed one of the longest bull runs in history, with returns in stock growth of more than 400%.

The clear lesson here is that if you react to everyday volatility, every correction, bear market and next predicted market crash, you will not only sell at the bottom but miss out on the subsequent bull market run.

#5 Bulletproof Investment Strategies For The Next Predicted Market Crash

This brings me to my final point. When we think about the next predicted market crash we have to realise how little control we have when it comes to investing. There is only the illusion of control. As we’ve seen the more action you take, the more you can actually damage your returns. The more you react to the events that cause prices to jump up and down, the more you can damage your returns.

However, if you opt to simply build a sensible investing strategy and allow your returns to compound up over time, ignoring all the noise, then the odds are significantly more in your favour.Obviously, your investments won’t spontaneously jump into existence and you do need to make some active investment decisions. For example, you can control things like how much you save and invest each month. Ultimately how much you decide to invest on a regular basis will be more predictive of your future wealth than most minor investing decisions.

5 Sensible Investing Decions You Can Make:

- Investing your money in a low cost, diversified portfolio that suits your goals.

- Using a super fast and efficient investment process that takes all the hassle away.

- Avoiding traditional investment accounts are clunky and full of jargon.

- Selecting a portfolio with a risk level that tolerance to volatility.

- Seeking out asset allocation gudience to tailor your investment strategy to your goals.

There are 8 index based funds that make my investing shortlist in relation to the above criteria for my personal investment trajectory.

Where To Start With Your Investing Journey

How To Calculate Your Investment Trajectory

When investing it’s important to have a time-frame and strategy to get you through the tublelent times. With this in mind you should plan out how much you need to invest each month to reach your financial goal. You can use my financial freedom calculator to do just that. All you need to do is select your target portfolio number, the years you want to reach it and what average returns you might expect.

The good news is that it’s never been easier to invest in the stock market. The next logical step once you understand what an index fund is and how to invest in one, is to choose a wealth manager and select a fund that suits your investment goals. Should you want to follow a similar route and invest with Fidelity then you can earn youself a £50 amazon voucher by using my referal link to open an account. Capital at risk. Exclusions, T&Cs, ISA and tax rules apply.

Alternative Options To Fidelity & Vanguard

Whilst there are the obvious institutions such as Vanguard and Fidelity, investing with them can feel arduous. With lengthy forms and complex decisions at every turn. Although my 8 shortlisted funds are all with Vanguard and Fidelity, you might feel you need to go in a different direction.

Luckily, there are some revolutionary fintechs disrupting the wealth management market. They are making investing simple, accessible and just plain easy. It’s fantastic how easy they make it to decide on a fund or asset allocation that suites your investment needs. These fintechs make is as straghforward to open an account but make manage and track your investments.

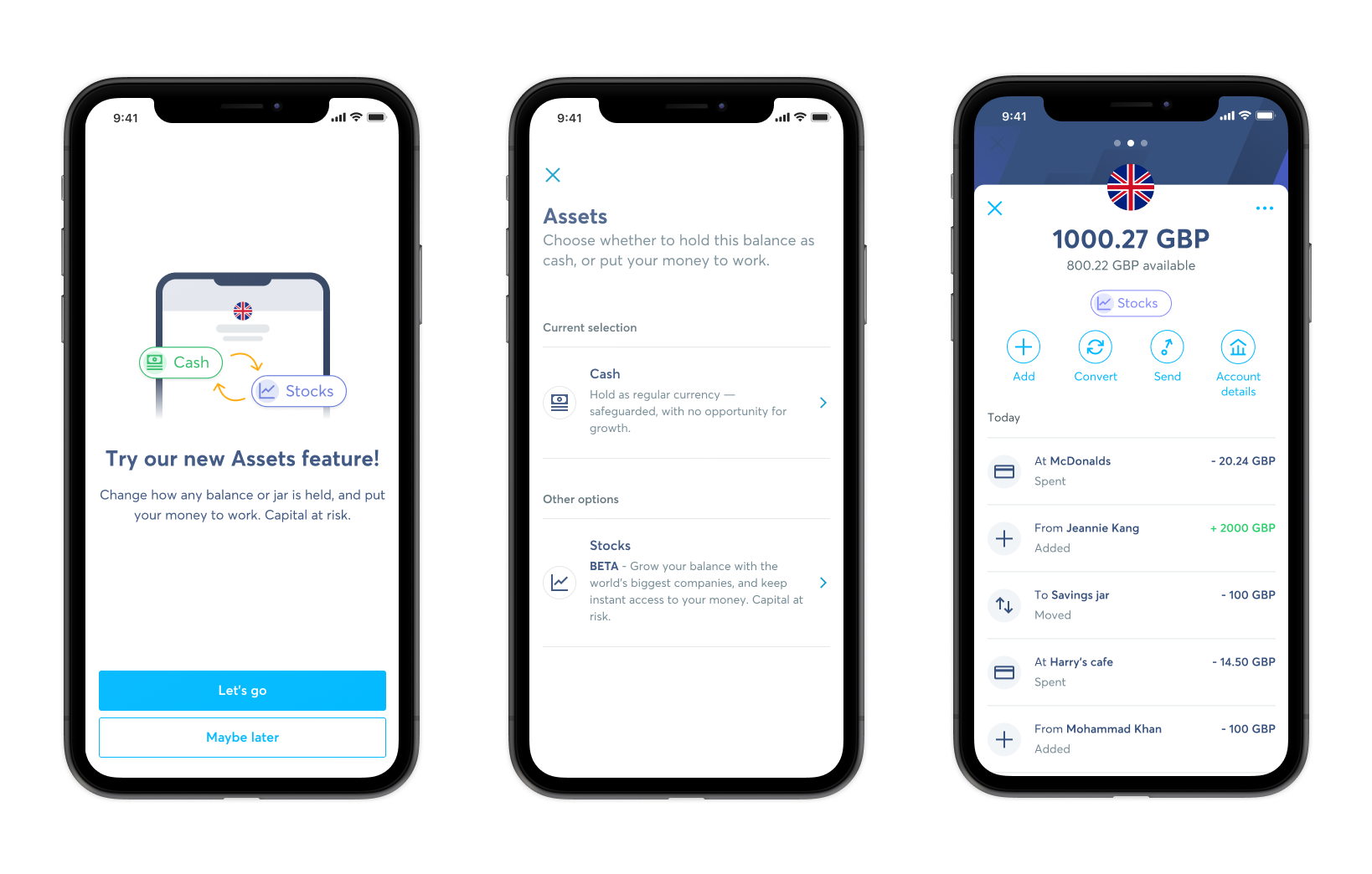

For example, Wise (formerly Transferwise)has recently launched an assets section of it’s app. You can open an account in minutes and from there you an move cash into assets in just a few clicks.I managed to open up a MSCI World Index fund in no more than about 5 clicks. In plain english the MSCI World Index is a collection of 1500 individual stocks from around the world bundled together.

Diversification in a portfolio is key, so 1,500 stocks is going to help with powering through the next predicted market crash.

Trackbacks/Pingbacks