You need to understand the time value of money if you want to build wealth and live your dream lifestyle.

Understanding the time value of money is possibly the most important money lesson of them all. It’s also the most unknown or ignored money concept.

This is because most people don’t realise that money can be used to buy time. As a result, you may have already (unconsciously) forfeited your time in exchange for a lifetime of paid servitude.

This is not the fault of the individual but due to the pressure of culturally agreed money myths. You will most likely have heard the phrases ‘retirement is a pipedream for our generation’ or ‘you can’t retire until 67’.

At the very least, the general consensus is that people are ‘supposed’ to retire in their old age. The theory that people can retire between the ages of 30 and 45 was astonishing even to me.

Rejecting this societal belief is the cultural equivalent of contesting the existence of gravity.

Why People Are ‘Supposed’ To Retire In Old Age

These money myths place retirement outside of one’s locus of control; a stubborn position that is widely accepted. When I have talked about early retirement to friends and family, I’ve been returned looks as though I’ve just arrived from another planet.

Beliefs about retirement are so strongly ingrained into the fabric of society that people do not like them contested. It makes people uncomfortable and this prevents them from taking action and ultimately what the politicians and large employers want.

Could you imagine if people started retiring early on mass? How else can you force a significant amount of people to work half their life?

To underline this point. I recently read one news article recently, where someone had £1,000,000 in a retirement fund. However, the government recently added another 2 years to the retirement age, delaying his retirement plans until 57.

This highlights that the goal is to make people like this work for longer, not to encourage saving.

Why Don’t People Care About Early Retirement?

Despite many accomplishing financial independence and retiring early in recent years, it’s still a very niche topic. As a blogger in this space, you don’t realize what an echo chamber Twitter, Facebook are until you have a real-world conversation.

I recently had a conversation with a group of colleagues at work, who stated that people ‘our’ age (millennials) will never be able to retire. The reason for this being around the myth that the government controls the age you retire.

This led me to state 3 things to the group:

- The maths behind retirement is actually surprisingly simple. You just need 25x your annual expenditure in a stock portfolio.

- By investing in stocks and shares ISA you can access the money whenever you want.

- People have retired in their 30s and 40s as a result of the above, it’s more common than you might think.

Obviously, these statements were jovially shrugged off. It was as though I was saying the earth is flat or that money literally grows on trees.

One person even went so far as to say: “I can’t be bothered to waste time on that”.

The reason for the above statement is because it’s difficult to comprehend growing a portfolio to 25x your expenses until you understand the mechanics of compound interest.

If I ask you to do 8 + 8 + 8 + 8 + 8 it’s reasonably simple (40), but if I ask you to do 8 x 8 x 8 x 8 x 8 it’s exponentially more difficult (32,768). It is therefore not intuitive to think that we can save this amount of money. By conventional saving methods, it’s not.

This Is A £70,000+ Financial Mistake

The reason I implore you to bear with me here is two-fold (if not more):

- By understanding the time value of money you can create passive income and have more choices in life (e.g. early retirement)

- The earlier someone begins their investing journey the sooner they start to harness the power of compound interest.

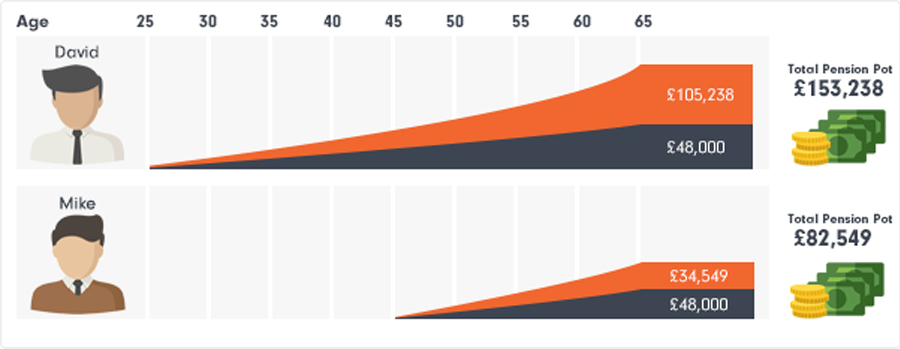

Investing starting at age 25 vs 45

- David starts investing £100 a month when he is 25; Mike invests £200 a month from the age of 45. So they both save the same £48,000 by retirement.

- Assuming a modest 5% annual return, the effect of compounding has longer to work on David’s investments

- At 65 David’s portfolio is worth almost twice as much as Mike (£153,238 vs £82,549)

Unfortunately, most people don’t start to think about retirement until 45. This dilutes the power of compound interest.

What Is The Time Value Of Money?

In its rawest mathematical form, the time value of money (TVM) is a concept that states; ‘the sooner you invest money the sooner it can earn compound interest’.

The formula for computing the time value of money must take into consideration:

- FV = Future value of money

- PV = Present value of money

- i = interest rate

- n = number of compounding periods per year

- t = number of years

The calculation is therefore: FV = PV x [ 1 + (i / n) ] (n x t) or more succinctly put: FV = P(1+i/n)(nt)

Let’s use a £10,000 example and assume it’s invested for 5 years, at an 10% interest. The future value of that money is:

Year 1 = £10,000 x [1 + (10% / 1)] ^ (1 x 1) = £11,000

Year 2 = £11,000 x [1 + (10% / 1)] ^ (1 x 1) = £12,100

Year 3 = £11,000 x [1 + (10% / 1)] ^ (1 x 1) = £12,100

Year 4 = £12,100 x [1 + (10% / 1)] ^ (1 x 1) = £13,310

Year 5 = £13,310 x [1 + (10% / 1)] ^ (1 x 1) = £14,641

In it’s more evolved philosophical form, the time value of money equates to freedom of time through passive income.

In the 4 hour work week, the author Tim Ferris refers to people who have freedom over their time via passive income as ‘the new rich’.

Why Would You Ignore The Time Value Of Money

The reason most people don’t care about saving, investing or retirement is because they do not understand this time value of money.

By investing early in your 20s and 30s, you can buy decades of future time freedom. Once people understand the time value of money, they realise it’s entirely plausible to retire at 40, 45 or 50.

When people understand the time value of money this usually results in a personal money paradigm shift. This results in massive action being taken and significant behavioural changes.

When I discovered the financial independence, retire early movement I did a number of things:

- Stopped saving entirely in cash.

- Tracked and cut my expenses (using excel spreadsheets).

- Started investing a minimum of £400 every month into the stock market

I now invest £600 per month which will rise to £800 by the end of the year, which has me on track to retire by 45. This is all a result of three concepts being unrealised:

- The power of compound Interest

- How index investing can provide potential returns of 10% per year.

- How to create sustainable passive income (e.g. 4% rule).

Ad clicks not only help to pay for my site but starting from 14.05.21 I’ll be giving10% of my ad revenue(track our progresshere) toGiveDirectly.Org

How To Create A Millionaire Lifestyle

The time value of money is technically a mathematical concept. However, the real value is in understanding that by applying it we can actually buy time.

Obviously, time is not a physical commodity to be traded, but freedom of time is a very real thing. With this, you can go anywhere and do anything without the physical and psychological limitations of being required at your job.

By harnessing the power of compound interest you can start to create passive income. Which reduces the number of years requiring earned income to drop rapidly.

The Elusive Lottery Win

People often talk about winning the lottery, so that they can live a millionaire lifestyle. With this money, they would quit their jobs and jet around the world on holiday.

What they fail to realise is that you don’t need a lottery win to do this. You simply need freedom of time and passive income.

With enough money invested and subsequently compounded up, it’s even possible to build a £1,000,000 portfolio. For example, if you invested £650 a month from age 25 to 55 with an average return of 7%.

However, the question is, do you need a million pounds for a millionaire lifestyle? Maybe you only need £350,000 or £450,000.

How To Harness The Power Of Compound Interest

In either instance, understanding the time value of money either as time freedom or compound interest is essential in designing the future lifestyle you want.

It’s plausible to harness the power of compound interest to build a portfolio that you can live off forever without working another day in your life.

To do this, you simply need to understand the basics of investing, and much you need to invest each month to reach your sustainable portfolio value.

Trackbacks/Pingbacks