You want to learn how to invest in the stock market but making the right investment decisions can feel daunting. Investing is a very specific niche topic and often a new frontier. Especially if you are looking into low-cost online investing. You might have completed years of education and be an accomplished professional (in a complex field), but never heard of an index fund. I’ve had many friends and colleagues in the sphere of analytics who have never even thought about investing. This is despite the fact they work with complex data and financial information.

We just aren’t given the information in schools, universities or familiar media channels. It’s not until recently that the online investing community and digital wealth management platforms have sprung into existence; to start giving you the tools and information to make sound investing decisions.

Do You Need To Be An Expert To Invest?

However, all of this extra information can suddenly feel overwhelming. This can make it seem like you need to become an expert overnight to start investing. The sheer complexity of investing the number of funds, asset types and classes you might receive information about only amplifies this feeling.

There are equities (stocks), fixed income (bonds), cash and cash equivalents, real estate, commodities, futures, and other financial derivatives. Just within individual stocks there are ordinary/common shares and preferred shares. Ordinary shares can also be broken down further into class A shares, class B shares.Bonds can also be broken down into several categories; Gilts (Government Issued Fixed-Interests Securities), Corporate Bonds, Investment Grade Bonds, High Yield Bonds, etc. So, it’s no wonder that even 90% of the experts fail to beat the market and why you may be feeling overwhelmed by the prospect of investing.

Disclaimer: This is not investing advice. You are responsible for your own investing decisions. When investing capital is at risk. This article may contain affiliate links.

Andrew | Mr Money Side Up

The Paradox Of Investing Choice

All of these individual types of investment can be grouped up into a fund. There are two common types of fund:

Mutual funds which will pool it’s money from investors. The active fund manager then invests the money in different types of assets including stocks, bonds, commodities, and even real estate. When you buy into this mutual fund you then buy ownership in a portion of the assets owned by the fund.

Exchange Traded Funds (ETFs) are similar to Mutual funds, as they also pool investor money but they are managed in a distinctly different way. This is because an ETF is a type of security that tracks (often passively) an index, sector, commodity, or other asset. It sounds complicated but it can actually be one of the simplest forms of investing.

How Do You Pick An ETF?

However, even once you get past individual shares (or other assets) and start looking at funds there are over 126,500 mutual funds and 7,602 ETFs. There has to be, to capture all of these types of assets and securities!

This is not to mention, insurance funds, pension funds, real estate funds, hedge funds or private equity funds. Even when you go to choose one of these 126,500 mutual funds. You then have to pick one that prioritises the assets you want to buy:

Equity (stocks)

Fixed-income (bonds)

Money market funds (short-term debt)

Stocks and bonds (balanced or hybrid funds)

There is an overwhelming choice when it comes to investing your money. This is what paralyzes most would-be investors. Most of them can also deter you from wanting to learn how to invest in the stock market. The added complexity of Mutual Funds can also make it seem like low-cost online investing is not a good option.

The Complex Psychology Of Investing

The complexity of investing isn’t even the most difficult barrier. What makes investing most problematic is that money is entangled with our emotions. The lack of knowledge you might feel you have, can lead to anxiety about losing money in the stock market. This loss aversion is just part of the complex psychology of investing that makes many people unlikely to ever invest.

Those that do invest, are often led to overcomplicate the process and when volatility and fear strikes the markets they are the ones hurt the most. For example, if you have multiple funds which are jumping up and down you might not know which one to invest or draw down from.

When it comes to investing there is actually a very simple path to wealth and understanding this can help you become a more confident investor. If you want to learn how to invest in the stock market, there are just 5 basics to investing that you need to know. They’re easy to learn and once you know them, investing will become much simpler and less scary.

#1 You Need To Invest Long-Term To Overcome Volatility

Everyone’s risk tolerance and time-frame is different when it comes to investing. There is no one-size fits all approach and you need to do what’s right for you. It’s important to remember this when you learn how to invest in the stock market. However, this article is relevant to you if you want to build and sustain wealth over the long-term, say the next 20+ years.

The reason for this is that historically the optimal vehicle for wealth building has been the stock market. However, it has also been the most volatile. Which is why you need to be prepared to endure and out-last the volatility. The longer you invest, the better your chances of not only returning a positive return but a stronger return.

If you invest over one-year intervals it’s really luck of the draw as to whether or not you will see returns of below 5%. It would be pretty risky behaviour to invest over 1 or even 5 year time frames. By contrast, the longer the intervals of investing the lower the probability of loss becomes. Historically, once you get to a 25 year period, getting an annual return of less than 5% becomes significantly less likely.

ETFs (e.g. Index Funds) Vs Individual Stocks

The above logic does not necessarily apply for individual stocks, so don’t get tricked into thinking that any individual stock is a safe bet. The more robust strategy is to have invested in an index fund. This is a portfolio of stocks or bonds designed to mimic the composition and performance of a financial market index (i.e., The Dow Jones, the S&P 500).

You can follow the same strategy by investing in something like the Black Rock’s iShares S&P 500 ETF. This would give you exactly the same exposure to the top 500 companies in the US at all times, regardless of which ones were promoted to the index.

It was a real lightbulb moment when I realised I could split my money into multiple assets without needing to buy a round number of stocks. This allows for greater diversification without a high investment minimum. Once this clicked I felt I really began to learn how to invest in the stock market.

#2 Diversifying Your Portfolio Is Crucial

Diversifying across geography, industry and asset class are three ways you can buy into a wide array of stocks. Diversifying can balance any losses from poorly performing countries, industries or assets against strongly performing ones. For example, in the early 2000s following the .com crash technology stocks performed very badly, by contrast Energy stocks had a great run. In recent years, this has flipped on its head.

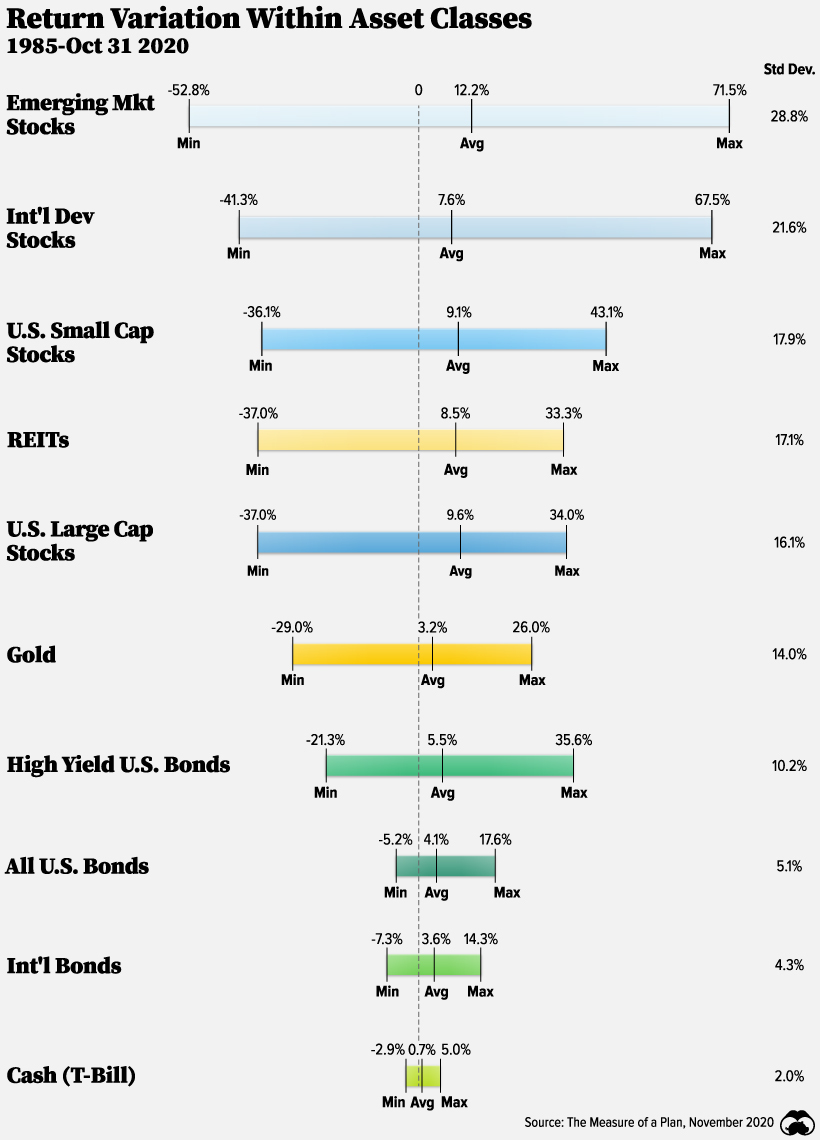

The type of assets you hold can greatly impact how much volatility you see hitting your portfolio. For example, you can see from the below chart that US Large Cap stocks discussed can fall by 37% or grow by 34% in any given year. That’s a pretty huge swing and one that definitely gives investors shaky legs!

By contrast, this range is only -5.2% and +17.6% for US Bonds and so you’re probably thinking you might want some bonds in your portfolio. However, the bottom line is that over time the average works out to 9.6% for stocks and 4.1% for bonds. So you have to consider how much volatility you are open to experiencing for long-term gains.

How Does Volatility Impact Your Returns In The Long-Term

Historically, if you would have held a balanced portfolio there are times you would have envied the returns of a benchmark index such as the S&P 500. However, as equities are highly exposed to losses, you have come out smiling in the long run.

How To Tailor Your Portfolio To Your Needs

When you learn how to invest in the stock market and go in search of a fund, remind yourself of where you are in your investment journey. Familiarise yourself with the average returns of each asset class. From there you can select a fund which fits for your risk tolerance to volatility and time-frame for building wealth.

At the end of the day, it’s up to you how much volatility you are prepared to experience in exchange for potential returns. You can change up the pace by tailoring your investment portfolio. It all depends if you want to take things slowly or run with it and take volatility in your stride.

Therefore it’s important to select a wealth manager that can continuously rebalance and blend your investments across geography, industry and asset class. For example, ikigai help you to change up the pace by tailoring your investment portfolio, depending on ‘walk’, ‘run’, ‘rise’, ‘fly’ or ‘soar’.

#3 Wrap Up Your Investments To Avoid Unnecessary Tax

One of the best ways to boost the money in your investments is to hide it from the taxman. I don’t mean hiding it in an offshore bank account in Panama! There are some legit ways you can actually avoid being hit by those cruel taxes. You might already know about cash ISAs, but you might be shocked at just how much a stocks and shares ISA can save you!

Let’s break it down. If you invested £20,000 per year into a general investing account for 5 years ( at 5% growth per year) you have £116,038 invested by the end of the 5th year. If you withdraw this money, you would get smacked by a £4,491 tax bill, assuming the current 28% capital gains tax rate.

All you need to do when you are ready to invest is to find a fund that is ‘ISA Ready’. This means any money you invest into this type of fund is tax exempt. Just think of all the extra money you will have by taking a moment to check you’re using an ISA.

How Much Can You Save With An ISA?

Without an ISA you will have to pay capital gains tax on your investment portfolio. However, if you manage it right then all of your gains, income, interest and withdrawals and income from your investment portfolio will be tax free. You are free as a bird to take that £116,038 and do whatever you like with it…. Tax free.

When the fund is ISA ready it simply means that the money in your fund has a tax-free wrapper around it. As of 2021 you can invest 20,000 per year into a Stocks and Shares ISA and pay zero taxes. So always look for a wealth manager that clearly highlights they offer stocks and shares ISAs. Just think of what you could spend that £4,491 on!

#4 Low Cost Online Investing Wins The Race

When you learn how to invest in the stock market your eyes might glaze over thinking about what your money might be worth in the future. As a result you can start chasing returns rather than focusing on the fees. It’s like how when you play the lottery you forget about the £1 or £2 for the ticket because you’re thinking about the millions!

These creeping fees can be subtle and hidden behind jargon and complexity, and have seen funds charge fees as high as 3%. Some of which is discretely spread across various costs such as transaction costs; which you might not see initially.

These costs are often higher for Actively Managed Funds, which is where a fund manager and their team of analysts will select specific stocks to trade, in an attempt to beat the market (they rarely do). As a result, active management fees are higher because of all that active buying and selling, transaction costs and fund manager fees for their ‘expert’ stock picks. The average expense ratio is 1.4% for an actively managed equity fund, compared to only 0.6% for the average passive equity fund.

How Much Will 1% Fee Increase Cost You?

1% might not seem like much, but when it comes to investing this can accumulate to serious portfolio losses. You can see this difference below, which is how a portfolio could be expected to grow over 20 years, if you invested £500 on an initial £10,000 investment.

#5 Automate Your Investments To Avoid Panic Mode

One of the most important concepts to understand when you learn how to invest in the stock market is to set and forget. This is for two main reasons:

- The less you look at your investments the better.

- You are less likely you are to try and time the market.

The more frequently you check your investment portfolio, the more likely you are to see it fall. Which can give you a distorted perception of your portfolio performance. It’s comparable to how people watch the news every night and end up with a warped sense of crime rates. Many would think that violent crime rates are going exponentially up, when in fact they have been trending down.

Investing Becomes Less Scary Over Time

Humans are risk averse and no matter how logical you think you are, a negative change will negatively affect your emotional well being. The majority of investors feel anxious about falls in the market; especially the new investors who can be more likely to see their investments lose money.

I can tell you from experience that It’s not a great feeling to invest your first £5,000 only to see it fall into negative territory. By contrast, once you have been investing for a while your overall return might be +40% (about what mine is now) and if the market falls by 5% I’m still ahead.

It’s all part of the same investment journey and you’ll get used to the ups and downs. You just feel it more at certain times throughout your life. For example, if your career becomes a little less stable, or your earnings dip or you don’t get a big bonus.

…And Don’t Try To Time Your Investments

When you learn how to invest in the stock market, you can’t allow your investment decisions to be driven by media speculation. This creates a warped perception of stock market reality. This may lead you to try and time the market or delay your investments. There is good evidence that the former can cut your returns in half. I have known people defer investing for months or years, for fear or a market crash that never materialised; when it did they were too scared to invest.

Delaying your investments can be just as bad. My previous article how to build a millionaire lifestyle, demonstrated that delaying your investments by 10 years can result in portfolio shortfall of -£70,689. That’s even if you invest twice as much to catch up in the following years.

Low-cost online investing is all about automating your investments. If you don’t automate your investments and forget about them, you might be reluctant to invest. Deciding whether or not to invest every month would take up considerable mental bandwidth, and potentially fill you with anxiety. Especially if you are intending to invest hundreds or thousands of pounds each month. The truth is there are just a few select actions you can take to be a great investor even if you have limited time or money.

In Conclusion…

When I started to learn how to invest in the stock market, I quickly realised that low-cost online investing was the best option for me. It’s such a simple way to grow your money and there are just 8 index funds that I have on my shortlist.

Personally, I like to invest into one of these once a month. This is generally because of how I am paid and how my core expenses and savings transfer. Low-cost online investing allows me to schedule this (automated) payment from my current account into my investment fund. I remove 90% of the human element. It also takes out most of the complexity of investing and it can be replicated by anyone by:

- Selecting a low-cost, diversified index fund. This broad approach to investing will offer a diverse selection of stocks across the stock market.

- Automate your investing so that there is a consistent investment into these stocks regardless of the highs and lows of the market.

- Using a wealth manager to manage your desired asset allocation so that I don’t have to manually rebalance my portfolio.

Ultimately, when you learn how to invest in the stock market you actually only need to understand a few simple rules. This is because being a good investor only requires a few simple actions. I just wish I had known these as a new investor, it would have been such a weight off my shoulders!

What Are The Next Steps Towards Low Cost Online Investing

You are in luck! There are so many great options to get started with investing such as the 8 index funds I referred to earlier.Low cost index funds are the vehicle through which I invest in the stock market. I currently use one of Fidelity’s global fund which is constructed of a number of index funds from around the world.

The next logical step once you understand what an index fund is and how to invest in one, is to choose a wealth manager and select a fund that suits your investment goals. Should you want to follow a similar route and invest with Fidelity then you can earn yourself a £50 amazon voucher by using my referral link to sign up. Capital at risk. Exclusions, T&Cs, ISA and tax rules apply.

How To Get A Free Share Worth Up To £200

Whilst it’s important to have a clear and structured investment strategy with someone like Vanguard or Fidelity there are some great alternatives.

There is no one-size-fits-all approach to investing. Whilst I am a fan of low cost online investing by using Index funds there are other ways you might choose to dip your toes in the water. For example, Freetrade is a fantastic example of how investing has been made simple, straightforward and easy.

You can buy individual stocks but you can also buy into ETFs and the Index funds we’ve been talking about. They now also offer low cost stocks and shares ISAs at a flat fee of £3 per month. Which means that you don’t pay fees or taxes on your stocks and shares.

Within minutes you can be invested in thousands of shares or just one single stock. In fact, if you use my affiliate link for Freetrade you can bag yourself a free share. Freetrade is a great app for buying individual shares or even index funds, so it’s worth checking out, if only for the free share (which you can always sell for cash). The stock could be worth up to £200 so it’s definitely worth trying.

The steps are simple:

Download the app using my Freetrade referral and create your account

Fund your account with at least £1

Get your free share!

Trackbacks/Pingbacks