Thematic investing is an approach that involves grouping investments around specific themes or trends. The helps investors capitalize on their potential growth and impact. It aims to align portfolios with areas of interest or anticipated future developments. By focusing on transformative changes in society, technology, or the economy, thematic investing offers opportunities for long-term growth.

Morningstar’s definition of thematic funds includes equity funds that select holdings based on exposure to one or more investment themes. For example, the legalization of cannabis or the transition to a low-carbon economy. It excludes funds closely resembling traditional sector funds and emphasizes four broad buckets: Technology, Physical World, Social, and Broad Thematic. Thematic investing allows investors to participate in and benefit from the growth of specific industries or trends that align with their interests and forward-looking perspectives.

Disclaimer: This is not financial advice and you are responsible for your own investment decisions. When investing capital is at risk. This article may contain affiliate links.

Are Thematic ETFs Building Momentum?

Investors are increasingly turning to thematic investing due to several key factors. Firstly, European investors significant have driven a rise in the use of thematic strategies over the past three years. There has been a 20-percentage-point increase in thematic investing strategies. This surge is driven by their desire to have a positive impact through their investments. With 70% of investors citing this as the primary reason for embracing thematic strategies.

Additionally, 63% of investors believe that investing thematically can enhance their investment returns. This indicates a strong belief in the potential for growth and profitability within these focused themes. Renewable energy and climate change solutions emerge as the most appealing sustainable themes among investors. Water themes and demographics/ageing populations are also garnering interest.

Investors who have not yet embraced thematic strategies express concerns over performance (49%) and high fees and costs (41%). However, Pieter Oyens, co-head of global product strategy at BNP Paribas Asset Management, highlights the increasing mainstream acceptance of thematic ESG investing. This approach enables investors to address long-term sustainability issues, transforming markets and creating value across portfolios. The report concludes that while the pace and composition of ESG thematic investing may vary across regions, the significant momentum observed in Europe is expected to persist.

Should Investors Be Sceptical About Thematic ETFs?

Investors should exercise caution when considering thematic funds, as they may resemble growth-stock investing rather than capturing elusive investment trends. While research from MSCI suggests that thematic stocks have the potential to outperform traditional growth stocks. With quasi-index of leading thematic stocks, put together by MSCI and drawn from several themes, performed better than a global growth-stocks index in five out of the six years 2017 to 2022.

A survey conducted by HanETF revealed that 42% of investors had capital invested in thematic ETFs. A figure comparable to those using ETFs to track broad stock-market indices. However, the performance of thematic ETFs mentioned in the article has been lackluster overall. For example, the iShares Global Water ETF has demonstrated stronger performance with a total return of 191%. This has outperformed the MSCI All-Country World index’s return of 177%.

On the other hand, some thematic funds, such as the HanETF’s Medical Cannabis and Wellness ETF, have experienced significant price volatility. Which has resulted in subpar performance due to their specialized focus and concentrated holdings. These findings emphasize the need for investors to carefully assess the potential risks and rewards associated with investing in thematic funds. It’s essential for investors to consider the uncertainties and challenges inherent in these strategies.

What Does The Future Hold For Thematic Investing?

Thematic investing has a promising future as it allows investors to tap into long-term trends that are reshaping industries and our way of life. BlackRock recognizes the potential of thematic investing and has incorporated it into their investment agenda. They have identified five global megatrends – rapid urbanization, climate change and resource scarcity, emerging global wealth, demographics and social change, and technological breakthrough. These are deemed to be the driving forces behind structural shifts in various sectors.

BlackRock’s Thematic Research and Investment Group (TRIG) plays a vital role in identifying these long-term themes nd determining the most suitable investment approach. This is both through index funds and active management. Their approach considers factors such as the investment universe, divergence between companies, and the presence of initial public offerings (IPOs) to guide their investment decisions.

By offering a range of thematic funds, both index-based and actively managed, BlackRock aims to capture the potential growth and opportunities arising from these megatrends. However, it’s important for investors to be aware that all investments carry risks, and there are no guarantees of positive outcomes.

Bonus Offer: Get £10 to invest in a Themed ETF with Wombat Invest

Thematic Investing Trends For The Future: Where Is The Growth?

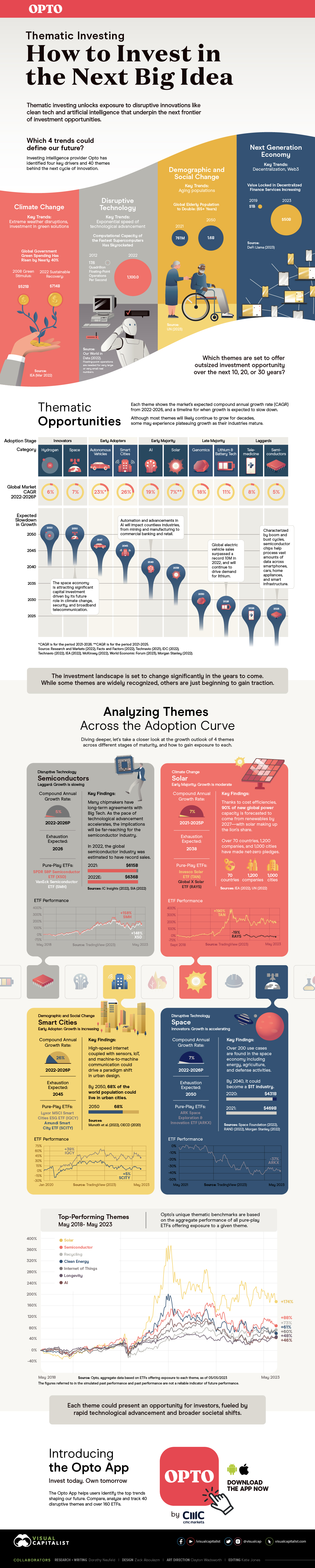

Thematic investing is gaining momentum as it provides exposure to disruptive innovations. These are driving the next wave of growth opportunities. Several long-term structural trends are reshaping society and offering potential investment prospects. One such trend is climate change, with global government green spending rising nearly 40% since 2008, reaching $714 billion in 2022. Another trend is disruptive technology, with the computational capacity of supercomputers increasing from 17.6 quadrillion floating-point operations per second in 2012 to 1,100 quadrillion in 2022.

Demographic and social change, such as aging populations, is also a significant trend, with the global elderly population projected to double from 761 million in 2021 to 1.6 billion in 2050. Additionally, the next-generation economy, characterized by decentralization and Web3 technologies, presents investment opportunities. These trends set the stage for thematic investing in the coming years, with themes like hydrogen, space, autonomous vehicles, smart cities, AI, solar, genomics, lithium, telemedicine, and semiconductors expected to offer outsized investment opportunities.

Read: Emerging Markets Diversification: Is The FTSE Global All Cap Enough?

Transformative Trends In Investing

As investors look to gain exposure to these themes, they can consider specific thematic ETFs. For example, in the semiconductor sector, ETFs like SPDR S&P Semiconductor ETF (XSD) and VanEck Semiconductor ETF (SMH) provide investment opportunities. In the climate change sector, the Invesco Solar ETF (TAN) and Global X Solar ETF (RAYS) focus on the solar industry. Smart cities can be accessed through ETFs like Lyxor MSCI Smart Cities ESG ETF (IQCY) and Amundi Smart City ETF (SCITY). Finally, for the space industry, the ARK Space Exploration & Innovation ETF (ARKX) is a pure-play ETF to consider.

Thematic investing is poised to capitalize on these transformative trends, driven by rapid technological advancements and shifting societal dynamics. The investment landscape is expected to evolve significantly in the coming years, with these themes offering substantial opportunities for investors seeking long-term growth and exposure to disruptive innovations.

How Can You Invest In Thematic ETFS?

Discover a world of Thematic Funds with Wombat Invest. This investing app is designed to meet your thematic investment needs. With a wide range of themes to choose from, you can invest in specific areas of interest and capitalize on emerging trends. The themes include Technologies, Scientific Investing, Global Brands, Ethical Investing, Food & Drinks, and many more.

Each Theme is represented by a basket of securities in the form of Exchange Traded Funds (ETFs), offering diversification and easy access to targeted markets. Investing in ETFs through Wombat Invest offers several advantages. First, it provides simplicity as you can invest in a basket of stocks that mirror the performance of a specific index without the need to purchase individual stocks.

You can also get £10 to invest in Wombat by using this link right here.(capital at risk). Wombat has a free instant general investment account (GIA). This means there fee to check out Wombat’s GIA and no pressure to start investing.

Low Cost Thematic Investing

Additionally, ETFs offer tax efficiency, with exemptions from stamp duty and the potential to benefit from tax advantages when held within an ISA or SIPP tax wrapper. Moreover, ETFs generally have lower costs compared to buying individual shares. This is thanks to fewer transactions and reduced trading costs.

You can take advantage of the benefits of Thematic ETF investing with Wombat Invest. Whether you’re interested in the Electric Car Revolution, The Future of Food, or The Space Age, the app allows you to easily invest in these exciting Themes and participate in the potential growth of specific industries and trends. Begin your investment journey today with Wombat Invest and unlock the opportunities of Thematic ETFs.

Read My Full Wombat Invest Review: Kickstart Your Investment Journey And Get £10 Free

When investing capital is at risk.

Conclusion: Are Thematic ETFs Worth Investing In?

In summary, investors are drawn to thematic investing due to the opportunity to make a positive impact. There is also the potential for enhanced investment returns, and the appeal of specific sustainable themes. Despite concerns around performance and costs, the growing acceptance of thematic ESG investing suggests its relevance. In addressing sustainability challenges and aligning with investors’ evolving objectives and regulatory requirements.

Thematic investing focuses on disruptive innovations and long-term trends. This presents a compelling opportunity for investors looking to tap into the next big ideas. Ideas that can reshape our society and unlock future growth. By investing in specific Themes through funds and Exchange Traded Funds (ETFs), individuals can gain exposure to niche markets, sectors, and transformative technologies. These have the potential to drive significant returns.

Strategic Diversification with Thematic ETFs

Counterarguments suggest that thematic investing is subject to higher volatility and uncertainty. This is due to the specific nature of investing themes. However, it is important to note that the strategic diversification offered by thematic ETFs can mitigate these risks.

By investing in a basket of securities within a particular Theme, investors can spread their exposure and minimize the impact of any individual company’s performance. Moreover, thematic investing aligns with the growing global megatrends such as climate change, technological breakthroughs, and demographic shifts.

Structural Investing Shifts Create Market Opportunities

These structural shifts are reshaping industries and creating new opportunities for companies at the forefront of these themes. By investing in Themes that address these megatrends, individuals can position themselves to benefit from the potential long-term growth and profitability associated with these transformative forces.

In conclusion, thematic investing offers a compelling way to invest in the next frontier of innovation and long-term trends. With the ability to access specific industries, technologies, and societal changes. Through thematic ETFs, investors have the opportunity to participate in the potential growth and disruptiveness of these Themes. While there are risks to consider, the strategic diversification and alignment with global megatrends make thematic investing a viable and exciting option. Especially for those seeking to capitalize on the ideas and trends shaping our future.

When Investing Capital Is at Risk

Resources:

https://www.visualcapitalist.com/sp/thematic-investing-how-to-invest-in-the-next-big-idea/

Blackrock 5 megatrends shaping our future

https://www.morningstar.co.uk/uk/news/234148/what-is-thematic-investing.aspx

https://www.investorschronicle.co.uk/news/2023/02/02/is-thematic-investing-a-smart-move/

https://www.msci.com/www/blog-posts/no-country-for-old-firms/03588863405

https://www.msci.com/www/blog-posts/the-pace-of-fast-change-growth/02386088177

https://www.msci.com/www/blog-posts/drawing-insights-from-thematic/03676492257