The major concern for investors right now is how to invest to beat inflation. The second is where can we invest when interest rate rises crash stock prices. Inflation is an insidious and erosive. It eats away at your hard-earned money and corrodes your investment returns. Stocks have been the usual escape vehicle but this may have changed.

Monetary policy makers such as the Bank of England (BOE) have been able to put aside any notion of fiscal policy. This is because inflation has tended to trend at 2% to 3% for the last couple of decades. Since the 2008 financial crisis, policy makers dropped the interest rate to almost 0%. They have also used methods such as ‘quantitative easing’ to stimulate the economy. Inflation is on the rise again. With supply chain shortages driving up prices and the artificial stimulus (e.g. printing of money) finally catching up with the economy.

The familiar economic landscape that we have of low inflation and low interest rates is changing. This leads to two simultaneous problems for investors. One if that investors must find assets that will provide returns above inflation. The second is that the value of assets such as stocks are falling. This is both a consequence of interest rate rises and increased costs eroding their profits.

Now many investors, for the first time in their life as faced with both falling asset prices and high inflation. Which raises a big question, where can we invest to beat inflation?

What’s The Big Deal With Inflation?

The last decade has allowed us to use stocks to invest against relatively minor inflationary pressures. The historical UK average has been just 2.48% per year. Which seems moderate but still means that if you saved entirely in cash, that money would have lost almost half it’s value (in spending power).

If you have had £10,000 sitting in a bank over 20 years, it’s real value would now be worth just £6,206. Even if you succeeded in saving £100,000 for your retirement; this will have fallen in value to the equivalent £62,055 in the following 20 years. This is the magnitude of the problem. Even during periods of low inflation such as 2.48%, you can see how wealth can be wiped out.

Now consider the impact of prolonged inflation above 5% or 6%.

The threat of inflation can make investors can feel squeamish because it eats into our returns. People who have no investments should be terrified. If you want to start investing then check out my beginner investing series. With every month or year that goes by, your cash becomes less valuable.

The factor by which it decreases in value compounds over time; which is what makes things more expensive over time. According to the BOE Inflation calculator; £100 worth of goods and services in the 1950s, would now cost £3,504.24 by 2020. This is because between those years inflation averaged 5.2% a year between these dates.

Disclaimer: This is not financial advice and you are responsible for your own investing decisions. When investing capital is at risk. This article may contain affiliate links.

Andrew | Mr Money Side Up

How Concerned Should We Be About Inflation, Right Now?

GDP growth can drive inflation when the economy expand at a faster rate than the needs of the population can be supplied (see, aggregate demand). This is exactly what we have seen. There have been a series of as supply chain shocks. This is in reaction to a rebound in growth following the sharp covid-19 contraction. At the start of Covid-19 the UK’s GDP fell by 20% in April-20 it then rebounded by 7.5% in 2021, the fastest since the 1940s.

As a result, the UK’s inflation rate hit 5.4% in January 2021 which is the highest inflation rate in 30 years. This far exceeds the Bank Of England’s 2% target. Consumer prices in the US have also risen at their fastest rate since 1982, pushing annual inflation to 7.5%. This means it’s getting hard to invest against inflation.

The pent-up and resurgent demand in goods and services as the economy re-emerges from forced hibernation. Initially we saw some localised price inflation in specific areas of the economy such as restaurants. Supply chain shortages then started to impact the broader economy in a more generalised way.

Inflation Caused By The Printing Of Money

There has been consistent and intense printing of money to support workers and companies hit by the pandemic. For example, there were Furlough schemes which paid 80% of workers wages. Then essential services were kept running by bailouts, such as the TFL bailout of £1 Billion.

One of the main concerns of people is that by printing more money. An action can devalue the currency and even cause hyperinflation (see, Germany 1922-23 for an extreme example). As a result of this devaluation, people request more money for goods and services. The continued extension of stamp duty holiday has also driven extreme inflation within the housing market.

According to Halifax, house prices hit a record £237,750 on average, With house prices jumping in value by almost 10% per year and at the fasted rate in 17 years. Mortgage rates also tend to stay ahead of the inflation rate, so even homeowners should expect to see their cost of living rise also.

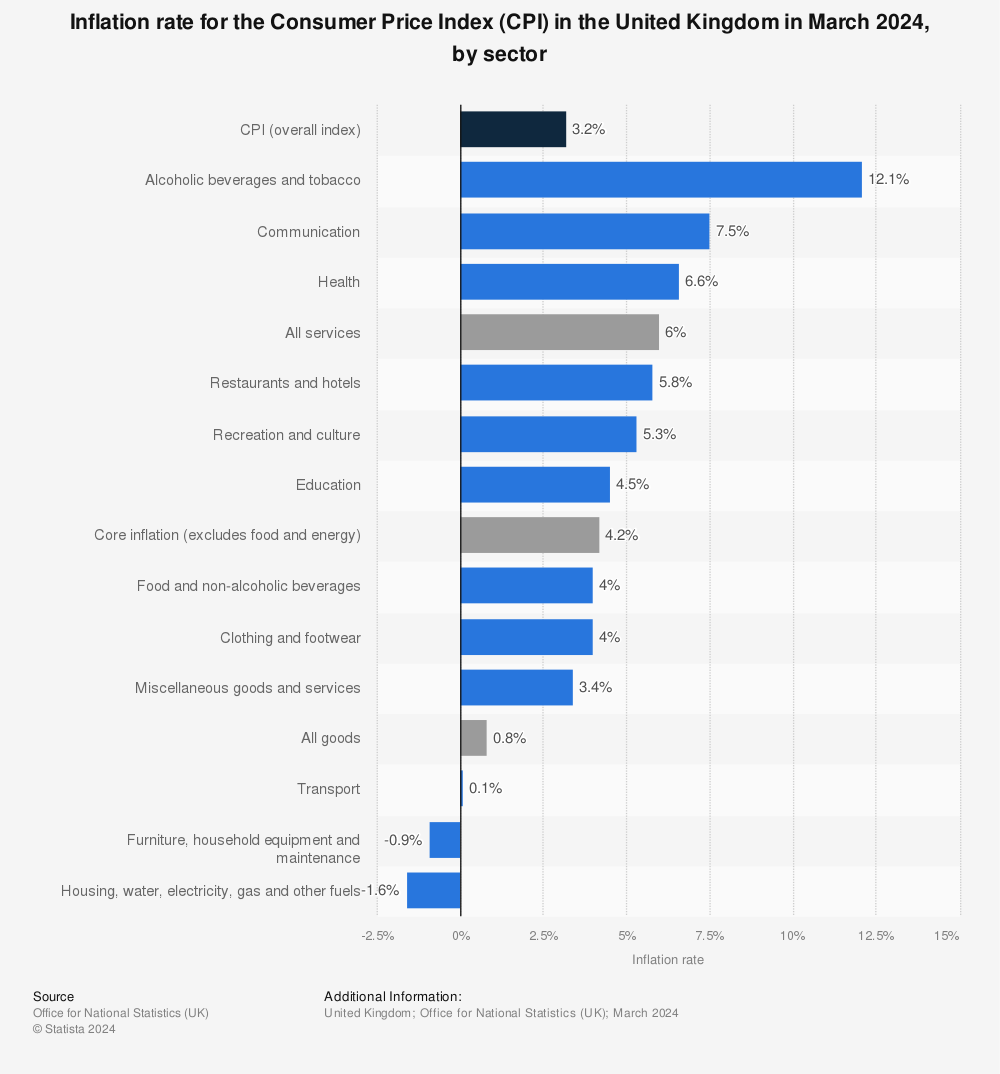

One metric that is frequently used to track inflation is the consumer price index (CPI). At the time of writing this article, there are some distinct inflation trends according to the CPI. This is the primary metric we should consider when understanding how to invest to beat inflation.

Find more statistics at Statista

The Opportunity Of Wage Inflation

It’s not all doom and gloom with inflation and the economy right now. For the first time in decades, we may be seeing a shift to the employee rather than the employer’s market. There are early indications that there is limited appetite for previously oversupplied jobs. Especially in retail and hospitality. This is pushing up wages. With the year on year wage growth was up by over 8% in April 2021.

This wage growth continued into the end of the year with average weekly earnings in the UK up by 4.2% when compared to the same period in 2020. In general, due to reduced immigration due to Covid and Brexit, the UK is seeing wages pushed up as the supply of workers drops in advanced economies. Whereas, the employer would have had 10 or even a 100 candidates, they may be fighting with other businesses for one.

Low unemployment levels of putting upward pressure on wages. Following limited attempts to curb inflation. The BOE has asked people not to ask for wage rises as this may add to economic inflation. They seem to forget it’s their responsibility to manage inflation and prefer to let people take the bite of the increased cost of living.

How To Invest To Beat Inflation: What To Expect From The Markets

Investing in the stock market is one of the long-term ways we can invest to beat inflation. However, equities are not for the light-hearted. In April 2020 stock market indices crashed at a record rate to 30% in 22 trading days. This was such as sharp contraction and rebound that we could almost void it off as a correction rather than a bear market.

We should expect much more volatility from the markets through this period of high inflation. Due to the increased costs, companies will now have a choice to either pass on increased costs to consumers to take a hit to their profit margin. Both might occur anyway as consumers have less income available to spend on products and services.

The situation is more dire for developing companies. For the past decade we have seen record levels of innovation and ‘unicorns’ emerge into the market. In 2022 it’s estimated that there are over 1,000 start-ups with $1bn or more. This is because of the high growth environment, structured by low costs and cheap debt.

Interest Rate Rises Are Sparking Fear In The Market

Monetary policy is changing to combat inflation and interest rates are rising. This increases the cost of borrowing. Every time the interest rates rise, it threatens to cripple of the current economic paradigm of near 0% interest rates. As a result, the markets panic and valuations slide.

We have already seen the indices such as the NASDAQ (-13.62%), Russell 2000 (-10.51%) and S&P (-7.88%) start the year in negative territory as the Federal Reserve turns hawkish on inflation. This has coincided with a poor earnings season for many companies, especially tech companies such as META which fell by 26%. That’s a $250bn loss in market value.

Oh and there is the potential war between Ukraine and Russia weighing on the markets. At times like this it’s interesting to keep an eye on the VIX index which tracks fear in the market. It seems a fairly safe prediction that we are going to see this index peak high and more frequently in the future.

How To Invest To Beat High Inflation: Tolerating Volatility In The Market

As inflation drives fiscal policy, there will be considerably more market knee-jerk reactions as interest rates rise and profit margins are hit. Companies that do not have good fundamentals and were relying on good-will and cheap debt to grow may hit a wall. Especially as spending within the economy contracts.

You always have to be prepared for the eventuality that your portfolio decreases by 40% or 50% with every bull-bear market cycle. It seems we may have come to the end of one of the strongest bull market cycles of our time. For the first time in many investors life-times we may be entering a bear market or at least a tough market.

Whilst stocks and index funds may become over or undervalued at times, times like this sift the wheat from the chaff. As successful investor Benjamin Graham once said, “in the short term the stock market is a voting machine but in the long-term it’s a weighing machine.“.

Therefore, it may be the case that we will lose some money before we make money in the long run. However, the fall in value actually means there is consideration buying opportunity.

Whilst it may seem young investors have had a good run, we’ve actually been buying stocks and assets at record valuations. Whilst the values have continued to go up (which obviously feels good!) we are paying over-the-odds for a companies true value and earnings. These market shocks could reset the scales and allow us to benefit more long-term from our investments.

Investing Through High Inflation: Are You Liquid Enough?

Whilst the prospect of buying shares and other assets at decreased value seems exciting. The more important factor is actually based on you. Can you maintain liquidity and solvency as the cost of living increases?

It’s no good to you if asset prices drop, only to find you do not have the cash to buy them. Can you meet your short and long-term financial commitments? Can you afford the cost of petrol, or your mortgage payments increasing? Do you have liabilities that outweigh your assets?

We have been lucky that unemployment has remained low and stock prices have continued to reach all time highs. This has meant we could focus a little less on building a war chest or cash and more on investing in the stock market. This may mean that you’re a little less liquid that you perhaps should be. It’s important to find a balance between beating inflation and also staying liquid enough to out-last price rises.

Investing Through High Inflation: Investing Strategy

In a recent article, I touched on how your investment strategy may vary if your investment time-frame is shorter. There are lot’s of strategic investing insights around investing during the potential 2020 Superbubble. From using Gold and Silver to hedge against stock crashes, to using balancing your portfolio.

In this article, I wanted to discuss further assets that can be used to cope with inflation and high risk market environments. That’s if you don’t have the appetite for the peaks and crashes of the stock market. However let’s be clear my personal approach will be to continue to pound-cost-average my investments through the market ups and downs.

My current investment strategy is to invest regularly into a stocks and shares ISA which contains Exchange-Traded-Fund (ETF). This contains a basket of global index funds (90%) and REITs (10%). Read more about index funds by clicking here. My core pension fund is also based on this approach and is invested into BlackRock’s Global ESG Equity Index Fund.

However I do believe that diversification can only be a protective factor. Therefore, I have been investigating alternative investments. There are three different types of investment I have been reviewing on my new favourite app Freetrade. Which is a low-cost commission free way of buying into different assets I would otherwise not have access to with Fidelity.

#1 Government & Treasury Debt

Inflation-index-linked bonds are the traditional methods of how to invest to beat inflation. This is because they increase in value during inflationary periods. These come in the form of:

- US Treasury Inflation-Protected Securities or Inflation Protected Bonds.

- Indexed UK Gilts – Inflation Liked UK Govt Debt.

With these index linked bonds, the principal increases with inflation. This means that at maturity, bondholders are paid the inflation-adjusted principal. Investors will never be paid less than their original principal when TIPS mature. However, If inflation does not materialize while TIPS are held, the utility of holding TIPS decreases.

The holding of UK gilts over a low inflation period is one of the reasons the USS pension has a deficit of £18bn. As of 2021 pension scheme still had 36% of its asset allocation of inflation-linked gilts. As of 2017 they indicated that these Gilts has returned -1.5% yield. Perhaps their fortunes will turn if inflation now drives upwards?

It’s also worth noting that TIPS and many of their global inflation-linked counterparts do not offer very good protection during times of deflation. Some economists are predicting a period of stagflation, so this is worth bearing in mind.

#2 Specialised Corporate Debt

Jeremy Grantham, renowned investor, advises investors away from treasuries and towards specialised credit. This is part of his suggests on re-risking from the ‘2022 Equity Superbubble’. This is something he details in his “Let The Wild Rumpus Begin” article. Specialist finance or credit refers to any non-bank finance that is granted by a private lender or institution.

This specialist companies may know how to invest to beat inflation better than traditional methods. Investors may be used to buying Treasury Notes and fixed-income bonds as a hedge against inflation but a smart approach may now be required.

One particular company I am interest in at the moment is BlackRock’s TCP Capital Corp. TCP’s primary investment focus is the origination of and investment in debt securities of performing middle-market companies. Essentially they buy the corporate debt and bonds from small and medium size businesses. They then negotiate debt payments to earn a profit on investment. This is one of the companies I have purchased shares in using the Freetrade app.

#3 Alternatives Investments

There is are widely differing opinions around weather the traditional 60/40 (stock/bond) allocation – seemed a balanced portfolio – is out-dated. Kiplinger wrote some recent coverage on a 33-33-33 approach to asset management.

This is grounded in J.P. Morgan Asset Management’s “Guide to Alternatives”. This research revealed that allocating just 30% to alternatives in your portfolio can substantially increase your annual returns. Simultaneously it can strengthen the portfolio stability and decrease risk. Alternative assets include venture capital, real estate (REITS), private equity and private debt.

Investing into early, late stage and pre-IPO companies is something I was already super-interested in before reading this article. Molten Ventures is another company I have purchased shares in via Freetrade. Molten are a venture capital company that invest in disruptors in technology and healthcare.

They have funded the likes of Revolut, Wise, Cazoo, Through machine, UiPath and Trust Pilot. Most recently they are financing Web 3.0 software company IndyKite, AI Company causaLense.

<Whilst you are here, you should bag yourself a freeshare worth up to £200 with Freetrade>

Beware Of Speculative Assets

As stock markets crumble and investment returns falter. You may be tempted to look towards other assets that can provide a quick win. In my opinion it’s still far better to invest in a reputable financial product that you understand. Cryptocurrency and leveraged crypto trading (far worse) is going to come back to haunt a lot of people. When valuations go to zero people will find they have borrowed money to buy coins that are worthless.

Therefore, I have 5 key rules for investing that I remind myself of regularly. These usually keep me out of trouble. This is also how I will invest to beat inflation:

- Maintain a low-cost investment base – Only invest with wealth manager that is transparent about fees.

- Build a diversified portfolio in terms of geography and asset type.

- Invest in both a diverse assortment of stocks across sector, industry and cap-size.

- Only invest in reputable financial products that are easy to understand.

- Decide on an investment strategy and don’t diverge away from a core strategy.

You can read more about the basics of low cost online investing by clicking here or jump to the 8 Index funds that make my personal shortlist.

Trackbacks/Pingbacks