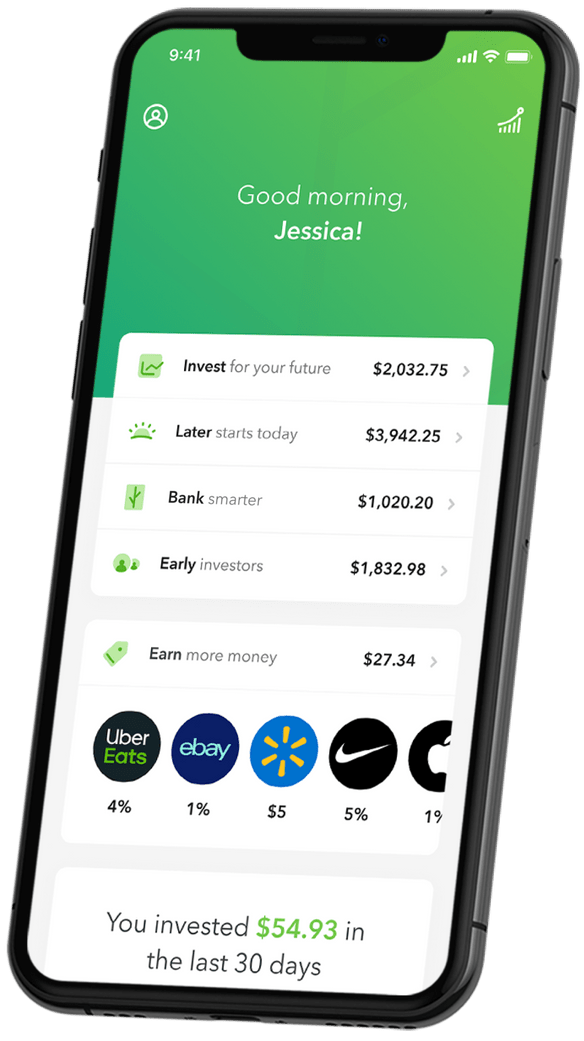

Should you use the Acorns app to Invest? This really depends on what you think about micro-investing. This is because Acorns uses the method micro-investing to help you build wealth. Acorns helps you bank smarter, save for retirement by saving and investing your spare change with Round-Ups®.

With Acorns you can open up a personal checking, investment, and retirement accounts all in one app. Alternatively you can link all of your credit or debit cards, so you can start automatically investing spare change with every swipe.

After each purchase, it rounds up the value to the nearest £1 and invests the spare change. For example, if you spend £0.80 then £0.20 will be invested. You can direct the money into a Traditional IRA, Roth IRA, SEP IRA, 401(k) Rollover.

The main features include:

- All-digital banking, with direct deposit, mobile check deposit, check sending, and more

- Instantly invest spare change and save from no hidden fees with over 55,000 fee-free ATMs nationwide and around the world FDIC-insured all the way to $250,000, plus fraud protection and all-digital card lock

- Smart Deposit built in – automatically invest money before you spend it and get paid up to 2 days early with direct deposit

- All of which is packed into a heavy metal debit card with a matte green finish and your signature custom-engraved

A freind of mine recently asked me what I thought about Acorns and the UK version called Moneybox. There are some #4 pretty good reasons for use Acorns and micro-investing in general (which i’ll cover below). However, depending on your personality there are also a couple of reasons you might want to skip micro investing.

Disclaimer: This is not financial advice. You are responsible for your own financial decisions.

Andrew | Mr MOney Side Up

#1 Automated Investing With Acorns

The core principle of Acorns is that it’s automated. This is now a key aspect of everyday life and one I think is also key to effective saving and investing. This allows people to invest painlessly and save more than they otherwise would. With Acorns you can:

- Invest spare change with Round-Ups™, invest a piece of every paycheck, earn more, and get money tips on the go.

- Access smart portfolios designed by experts, that adjust automatically as you and your money grow.

- Backed by leading investors and innovators, from Blackrock to CNBC, and chosen by more than 8 million people.

Every dollar you invest is automatically diversified into ETFs which include more than 7,000 stocks & bonds. This is all possible due to Fractional Share Ownership in our portfolio ETFs.

Acorns also uses Sustainable Portfolios which are made of funds that have been selected based on their environmental, social, and governance business practices, or their ESG rating. This allows you to invest in yourself and the planet.

#2 Acorns Fixed Fees

The fees for Acorns range from $3 (individual plan) or $5 (family plan) per month. Although this is easy to understand and transparent it’s also quite expensive if you are investing in quite small sums. Based on the idea that you are investing in small change, this is quite likely. By contrast, a percentage based fee, on a Vanguard Index fund, for example,may result in more low-cost fees.

However, transparency is key when it comes to investing and it’s great to have a very specific and rounded fee that you can expect to be charged. This is also going to be offset by the fact you can earn more when you shop with bonuses at over 350 brands.

#3 Acorns Investment Principles

Acorns allow people to start investing in an accessible way and use Exchange Traded Funds. ETFs for short, are made up of broad holdings of stocks or bonds. Often, these ETFs replicate an asset class or index like the S&P 500 or Dow Jones Industrial Average.

As a result you can easily invest in a asset classes that represent certain categories or classes of stocks or bonds. Each ETF represents an asset class in your portfolio ranging from Bonds to Large Companies.

Acorns also does a lot of the heavy lifting for you, so you don’t have to think about it. For example:

- Invest your spare change with Round-Ups®

- Diversified portfolios built by experts

- Portfolio rebalancing

- Recurring investments

#4 Acorns & Gateway Investing

Acorns is a good way to reducing fear of the stock market and with exposure and experience to investing. If you feel like the biggest risk is some loose change, perhaps you are more open idea of investing in the stock market.

I do agree with the idea of Acorns using Index funds. These are structured in conjunction with Vanguard and Blackrock. There’s a range of funds to suit each investor’s risk tolerance. For the investor that wants growth and “risk”, there is a fund which consists of:

- 40% large company stocks

- 20% small company stocks

- 10% emerging markets stocks

- 10% real estate

- 20% large international company stocks.

There are also more moderate risk based portfolios which include Short Term USD Bonds for example:

Spend-To-Invest Strategy

The idea of having to spend money to invest also seems counterproductive. I would want to invest as much as I can each month and this would be limited by frugalism. At a fundamental level, spending to save makes little sense. You might think one month, “I’ve saved a lot of money because my Acorns fund has a healthy amount in it”.

By contrast, you’ve actually spent a great amount of money and this is the result. Secondly,in a similar way to how reward cards work for retail companies, investing could incentivise spending, especially if the market is doing well. The idea of investing on an ad-hoc basis doesn’t work for me. Evidence shows that pre-committing to saving improves savings. Personally, I need to have clear direction, goals, and expectations regarding long-term investment returns.

In Conclusion… Ask If Micro-Investing Works For You

Personally, it’s not for me. I prefer to invest using a set monthly payment plan, which stems from an overall understanding of my finances. However, micro-investing is a fantastic way to get involved with investing without feeling the massive weight of risk. With either approach there are10 golden rules for investing that I would follow.

Automation is key when it comes to managing your finances and it can really make the difference when it comes to growing your money. There are some great Fintechs that can help you build automation into your finances. Should you feel that Acorns is not for you, then there are some great alternatives for saving and investing.

If you like the idea of Roundups, Revolut is using spare change round-ups, we’ll round-up your Revolut card purchases to the nearest whole number, and stash the difference in your Vault. For example, if you spend $2.90 on coffee, we’ll round it up to $3.00 and place $0.10 in your chosen Vault.

I have always wondered whether micro investing would fit me, but I’ve never got into researching or finding answers.

After reading your article I can state that it’s definitely not for me. I pay myself first after every payslip and invest any savings left, so paying extra fees for this service wouldn’t be smart.

It may would work for someone who can’t save a penny by the end of the month though?

Thanks for your comment! I’m glad my post has helped.

I was very tempted by micro-investing, but like you, I prefer to pay myself first.

I agree it’s one of those things that comes down to personal preference. Like you say, for people that struggle to save anything by the end of the month.

Although, perhaps that’s covering up the underlying issue of why that person is struggling to save?