Which are the best banks in the UK for customer service? Is it time for you to switch banks and potentially earn a switching bonus?

Are you fed up with your bank and want to know which are the best banks in the UK for a decent service? Are you fed up with spending hours on the phone or navigating clunky websites? I remember the days of loud sighs and constant frustration with my previous bank. I won’t name names but they score 63% in terms of customer satisfaction according to one survey. There’s just nothing worse than not being able to easily access or manage your money.

When it comes down to it the best banks for customer service are the youthful neo banks. That’s because they can offer high customer service levels resulting in high customer satisfaction. This means that if you’re after the best banks for customer service in the UK, then these online banks are often the way to go. In this article I’ve reviewed three of the best banks in the UK for customer service.

Traditional Banks Are No Longer The Best Banks For Customer Service

Traditional methods of banking have started to fail and are struggling to keep pace with modern technology and consumer demand. This means they are no longer the best banks for customer service in the UK. As a result, they are falling behind and becoming unprofitable. This further impact the banks ability to offer high customer service levels.

Tesco is just one example of this having decided to close down, shutting 213,000 current accounts in the process. M&S are also closing all current accounts in August and shut in-store bank branches. As a result you might need a new bank to switch to, fast! Long-running trend of brick-and-mortar banks closing branches is only going to increase. At the time of writing this article Lloyds had recently closed a further 44 branches. Traditional banks are struggling to provide adequate levels of customer service. They simply aren’t set up for the online demand.

According to Which, Natwest is down in 12th with a 67% customer score. Lloyds is even further down in 14th, with a customer score of 69% (of 100%). By contrast, digital challenger banks such as Starling, Monzo, First Direct all ranked in the top 5, with scores of 77% of above. These customer service scores are pretty definitive in deciding which are the best banks in the UK. Below you’ll find the best banks for customer service in the UK.

Which Are The Best Banks For A Cash Switching Bonus?

Most recently, I switched for money and not love, £125 to be specific and it seems to be going ok. Which is something I do regularly and if you switch right now you earn yourself a nice £140 bonus by switching to HSBC. Nationwide are also offering switching bonuses to existing customers (£125) or new £100) to switch to a Flex 0r FlexPlus account. There are also connecting savings accounts with reasonable interest rates to consider.

Remember, you can have more than one bank account. I usually have one or even two digital bank accounts on the go for my spending, especially If I am aboard. Some people say you should marry once for money, twice for love and the same can be said of your bank account. You can switch for money but if you are truly at your wits end with traditional banks, then one of the following banks might be for you.

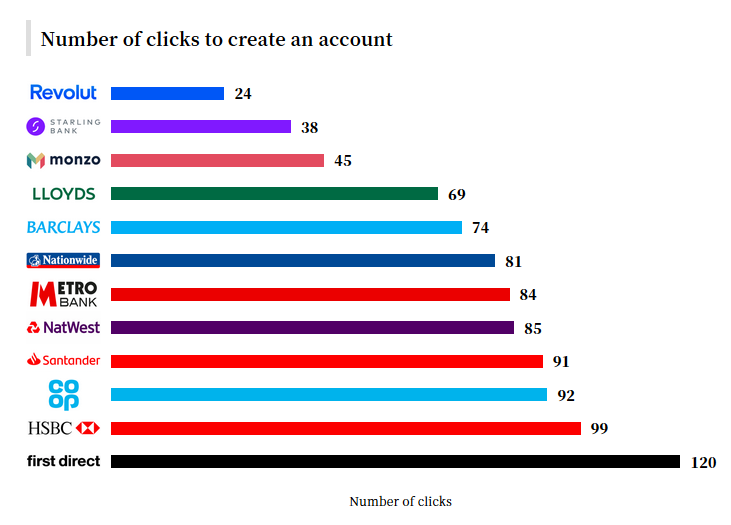

Who Are The Best Banks For Customer Of Service: Number Of Clicks To Open An Account

It can also take significantly less time to get setup with them clicks to get up with from when you apply to when you receive your card. For example, with Revolut it takes just 24 clicks to open an account. You can read my thoughts on Revolut here or simply download the app and open an account.

Being able to open an account quickly and efficiently is a key decider in which are the best banks in the UK, nobody wants to spend hours filling in online forms. We’re so used to just using our google account to sign up to apps and online services these days. Judging on speed to account opening alone Revolut, Starling and MAonzo are hte hest banks for customer service (UK).

Which Are The Best Banks In The UK For Customer Service?

We are facing a revolutionary period of retail banking, which is not without some challenges for the consumer. You might find that the branch you no longer visit is no longer open, or your current account is going to be closed. Alternatively, you might find that you simply struggle to get through to your bank, get stuck on hold or passed around numerous departments.

This is because traditional banks cannot design or innovate in the same way that these new start-ups can. They have to regenerate and replace decades-old legacy systems. They are not able to build from scratch with the modern customer in mind. If you want the best service with the latest features, you will have to switch to a digital challenger bank. The question is, who do you switch to?

If you bank is closing down as we speak you will need a fast and efficient switching process. You’ll also want a bank that you can you can confidently trust to protect your hard-earned cash. Ultimately, this will probably decide which are the best banks in the UK for you right now. Below are three of the top banks for customer service in the UK.

#1 Starling Bank – “Award Winning Bank Accounts”

Starling Bank is an award-winning, fully-licensed and regulated bank built to give people a fairer, smarter and more human alternative to the banks of the past. It offers personal, business, joint, teen, multi-currency accounts and a range of lending products. As a result it scores a 88% customer score and can therefore be considered the best bank for customer service in the UK.

Alongside this there is also ‘Kite’: banking for kids. Which can help kids learn how money works. Kite is a space linked to your account, designed to help them manage their pocket money with their own bank card and app. Some of the other features you get with Starling Bank are:

- No monthly fees current account.

- 100% digital sign up.

- 24/7 UK customer support.

- Protected by Financial Services Compensation Scheme.

- Instant payment notifications.

- Visual saving spaces.

- Round up transactions to put saving on autopilot.

- No fees overseas.

- Mobile and online banking.

- Your spending categorised.

- Mobile cheque deposits.

- Instant card locking security.

- Use with mobile wallets.

- Split the bill with friends.

- Send and receive international payments (for an additional charge).

- Get better at saving and budgeting, and view your monthly spending analytics.

- A branch that lives on your phone.

- Deposit cash at the Post Office and scan cheques in-app.

Your eligible deposits in Starling are protected by The Financial Services Compensation Scheme (FSCS) up to a value of £85,000 per person.

#2 Monzo – “Banking made easy”

Monzo is one of the best banks for customer service in the UK. More than 5.38M people use Monzo’s brightly designed ‘coral cards’ to manage their money and spend around the world. In fact, hoteliers and restaurants around the world would often comment on this as I used it to pay in places such as San Francisco or even Bali. As I did I would get an instant notification on the payment so I knew exactly how much I had left in my account to withdraw or spend.

Since then I can see that Monzo has now added a range of accounts and features such as Plus, Premium, Joint accounts or easy access or fixed-term savers. Monzo comes second only to Starling bank in customer satisfaction, scoring 82%.

You may have noticed that Monzo recently got into some hot water and is facing an FCA investigation over money laundering, all whilst facing £115m in losses. However, your eligible deposits in Monzo are protected by The Financial Services Compensation Scheme (FSCS) up to a value of £85,000 per person.

#3 First Direct – “The money wellness revolution is here”

First Direct has been fine tuning their online banking experience for over 30 years now and scores a 79% customer satisfaction score. They were one of the first companies to disrupt what online banking could look like with their revolutionary branchless banking experience. As a result, you can quickly and easily check balances, move money, set up payees and pay bills with secure Mobile Banking App and Online Banking.

You’ll always be able to speak with a fellow human here in the UK, 24 hours a day, 7 days a week. There is also a wellness hub to help you through the trials and tribulations of financial life and just life, in lockdown and well beyond. This leading initiatives are what makes First Direct one of the best banks for customer service in the UK.

The Best Bank For Customer Service By Time To Get Your Debit Card

The time to get your debit card is one of the key metrics for deciding which UK Banks offer the best customer service. Whilst First Direct didn’t score too highly on the clicks required to open and account, it’s still one of the fastest for getting your online banking open and debit card out to you. Gaining access to your new account and having your debit card are probably two of the most important factors in deciding which are the best banks in the uk.

Which Are The Best Digital-Online Banks In The UK

In conclusion, these are the best banks for current account in the UK. At least, when it comes down to being the best banks for customer service. Not only are these digital banks the best for service but it’s also super straightforward to open a current with them.

There are a whole host of reasons you should consider switching to a digital bank. It’s just incredible how many diverse and awesome features online banks are bringing to the marketplace.In fact I’ve picked out 8 revolutionary fintech companies which I think we should be paying attention to right now.

There are also 5 digital banks which are the best banks in the uk for helping you save money. They have really been designed to help you save money, optimise your spending and even help you invest. Rather than just giving you basic send and receive features, or worse by encouraging you to take out loans and mortgages to fill their pockets.

Digital banks are much more tailored to Millennials and GenZ than traditional high street banks. The older banks are still focusing on the older generations (e.g. boomers). They are struggling to keep up with youthful Fintechs. So in the end it will probably make sense to start taking advantage of a service that’s tailored to us. It’s like how I would compare my experience of Netflix vs Sky. One is low cost, personalised and cool. The other is expensive and can’t even remember where in a series you have got to.

Trackbacks/Pingbacks