The housing price crash is only just beginning. Here’s why it’s about to get a whole lot worse. This is why house prices are crashing, and why the falls are about to get deeper. House prices may have only fallen 5% since last year, but the worst is yet to come. This article will explain why.

Based on data from the Financial Conduct Authority (FCA), over half a million fixed-rate mortgages are due to end in November, December, or January. As interest rates have been steadily rising, homeowners transitioning to new mortgage deals will face significantly higher monthly payments compared to their previous rates.

The Bank of England’s 14 consecutive rate hikes have brought the base rate to 5.25%, impacting mortgage costs and savings returns. This is at a time when the UK’s economic outlook is worsening. The jobs market has one warning signal flashing red; the UK is undergoing the steepest rise in unemployment in the developed world.

Household debt is growing as are layoffs and insolvencies. All of which threaten to push the UK into a deep recession. As a result, Severe financial challenges facing millions of homeowners in the UK as their super-cheap fixed-rate mortgages from 2021 are set to expire in 2026.

Disclaimer: This is not financial advice and you are responsible for your own financial decisions. I am not a mortgage broker or advisor and I don’t give financial advice! Please consult professional advice before making any kind of mortgage decision.

The Fuse Has Been Lit For The Mortgage Timebomb

According to the Bank of England, around half a million people are expected to see their monthly mortgage payments increase by £500 to £749. While 250,000 households could face a substantial increase of £1,000 a month, equivalent to £12,000 a year.

As interest rates are predicted to rise further, homeowners are advised to calculate the potential impact on their finances. Homeowners may also want to consider methods of reducing the burden of higher mortgage rates. For example, extending their mortgage to reduce the monthly payments.

For the typical borrower rolling off a fixed-rate deal over the second half of 2023, monthly interest payments will increase by around £220. Higher rates are expected to affect the vast majority of the remaining home loans by the end of 2026. This is when the bulk of five-year fixes expire.

Read: The House Market Crash Is Much Worse Than It Seems Right Now

The End Of The Buy To Let Industry

This spells the end of the Buy to Let industry, as we know it. There is going to be a huge injection of supply into the property market. This will be fuel on the fire of the housing price crash. As UK landlords are already grappling with a 40% surge in mortgage interest payments. This is expected to reach £15 billion over the past year, says data from Hamptons.

This rise results from a combination of factors, including new investor purchases at higher interest rates, increasing tracker rates on existing mortgages, and the expiration of fixed-term mortgage deals. According to Savills director of residential research, Lucian Cook

“Buy-to-Let finances for a 70% loan-to -value investor went into the red for the first time since 2007 in Q2 of this year. With limited tax relief and higher mortgage costs it has become the domain of the cash rich.”

Landlords Forced To Sell Portfolios

The Guardian recently told the stories of people falling behind on mortgage repayments. One of which was a landlord who has been forced into selling their 16 rental flats. The landlord report’s that it is no longer financially viable to be a landlord and…

“The rents are no longer covering our mortgages; we’ve had a shortfall every month of between £2,500 and £3,500 for the past six months. We’re on SVR and the payments have doubled. I tried a couple of days ago to talk with some lenders about switching to a fixed rate, but they wanted to charge a fee of £3,000 for each property to go on a fixed deal, so it’s not worth it.

“We’re now in arrears of around £900 with service charges that we can’t pay. We’re panicking because we’ve got no money left, and can maximally carry on for another three months.”

With just only had one viewing and no offers, some of their properties are in negative equity as they were bought in 2007, before the global financial crash.

Read: 5 Reasons House Prices Will Keep Falling In The UK

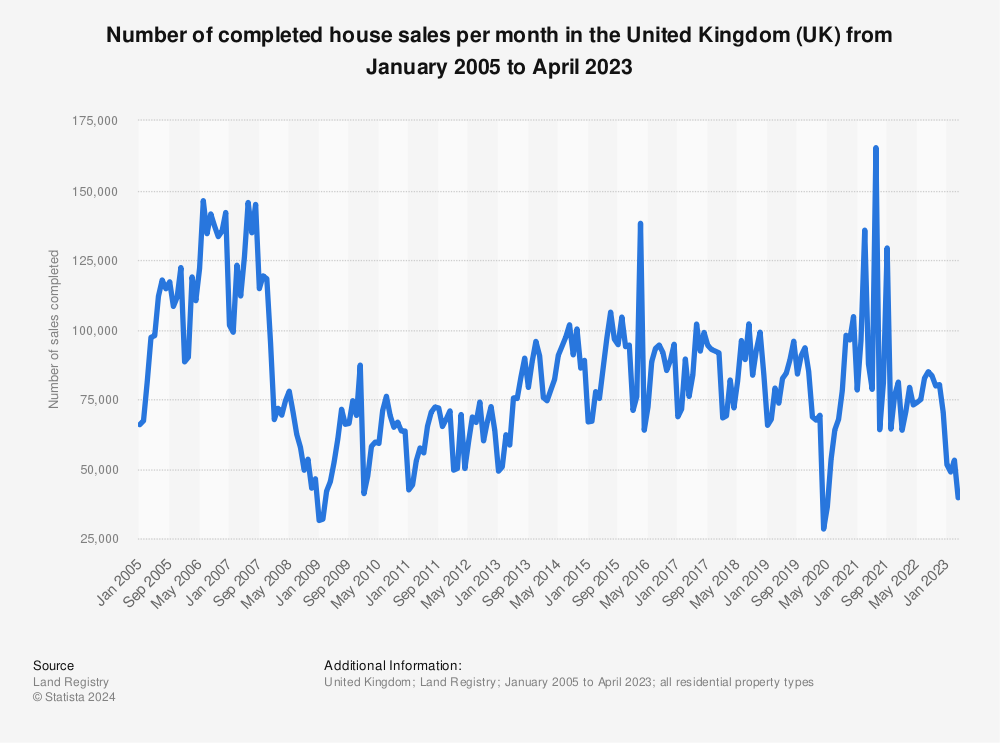

Residential Transactions Have Fallen Through The Floor

The reason for very low interest, is because there is almost no demand in the UK. Based on the data available, in April 2023 there were just 39,580 house sale completions in the United Kingdom. The last time completions were this low was April 2020 (the start of the Covid-19 pandemic) at 28,356. This means that transactions are nearly at the level of the last financial crash in 2009 (31,442).

Property demand has only weakened since April 2023 and I expect that when the data catches up to now (October 2023), these recorded transactions will be even worse that the pit of 2009. This means that unless sellers price ahead of market falls, there is very little chance they will have any interest.

Find more statistics at Statista

Sentiment From UK Banks Is Increasingly Negative

The banking sector has to be incredibly careful not to cause a panic. In this respect they have often issued soft messaging when it comes to the UK Housing Market. Lloyds Bank, issued a clear warning that UK house prices will not stop falling until 2025. Britain’s biggest mortgage lender forecasts 5% drop over this year and another 2.4% decline in 2024. It is highly uncommon for UK banks to warn about house price falls.

The evidence suggests that house prices will crash much further than 7.4%. On the Moving Home With Charlie Youtube Channel Charlie and his guest, Alex, express concerns about the current state of the housing market. They discuss the significant drop in house prices and the Deadly Triple Time Lag Trap.

From a mathematical perspective, Alex provides a detailed analysis of the correlation between wages, house prices, and interest rates, suggesting a strong connection that could lead to a 30-40% real drop in house prices.

Evidence Of The Housing Price Crash Will Be Clear By Spring 2024

The acknowledgement of the impending UK housing price crash is just beginning to surface. Mainstream media and UK banks are gradually shifting their stance to warn the public about potential house price declines. However, this warning comes late in the game, considering the substantial time lag between house price drops and their official reporting.

In fact, house prices have already been on a downward trend for some time, showing a year-over-year decrease of approximately 5%. It’s expected that even steeper and swifter declines will soon materialize. A combination of factors, including persistent inflation, declining real wages, elevated interest rates, and a surge in housing supply, are all contributing to the likelihood of a housing price crash that could be more severe than most are willing to acknowledge.

Despite the mounting evidence, there remains a degree of denial within the housing market. Prominent industry experts are still suggesting relatively modest declines in the range of 5-10%. The stark reality, however, points to the potential for a substantial correction in house prices, potentially reverting to levels last seen between 2007 and 2013. Unfortunately, most people won’t realise until March-April 2024.

The housing price crash is now expected to continue into 2024, with falls as far as 2025. This means that most will not see the bottom until late 2025 or even 2026. As a high percentage of homeowners don’t come of their low rate fixed mortgages until Q4 2026, the housing price crash could extend to 2027.