House price predictions for the next 5 years are surprisingly optimistic. Recent headlines might create the impression of a stable housing market, with five-year forecasts projecting growth starting in 2024. While indications suggest minimal price declines in 2023 and 2024, the optimism warrants scrutiny.

These developments come on the heels of Nationwide and Halifax HPIs reporting month-on-month price increases from September to October 2023, hinting that the speculated house price crash may have already subsided. Eye-catching headlines proclaim the end of house price falls, citing supply shortages and economic factors. However, these optimistic five-year forecasts rest on uncertain economic assumptions, which merit closer examination below.

Disclaimer: This is not financial advice and you are responsible for your own financial decisions. I am not a mortgage broker or advisor and I don’t give financial advice! Please consult professional advice before making any kind of mortgage decision.

Recent House Price Predictions For The Next 5 Years

Sky News recently reported that “the average house price predicted to be £45,000 higher by 2028”, with predications that the average property value will increase to £300,108” by 2028. The justification being that the market is expected to stabilize around mid-2024. With a projected 3.0% decrease in average house prices in 2024 followed by increases in subsequent years. Transactions are anticipated to rise gradually, reaching 1.16 million per year by 2028.

Sky also reported that House price growth returns in October due to ‘constrained supply‘ of properties. Meanwhile the Guardian headline said the UK housing market is past its ‘peak pain’. All of this information is predicated on interest rate falls, which we will examine shortly.

Read: The Truth About The October 2023 Nationwide House Price Index

Savills House Price Predictions For The Next 5 Years (November 2023)

The Savill’s housing market forecasts for 2024-28 present a nuanced outlook and distinguish between prime and mainstream markets . In prime central London, price growth is anticipated to be stagnant at 0.0% in 2024. On the other hand Outer Prime London House Prices are expected to fall -2%. This is due to a slowing global GDP. This will be due to a more robust global economy and decreased political instability post the upcoming election.

Over the medium term, Savills say the market is expected to benefit from limited supply and declining inflation and interest rates. Which would culminate in a 5-year house price growth of 17.9%. Conversely, outer prime London and prime regional markets face challenges, with higher debt costs contributing to continued price declines in 2024.

Mainstream markets face falls across all regions in 2024 before returning to nominal growth in 2025. With persistent single-digits growth expected between 2025 and 2028. Inflation and wage growth will dictate if this translates into real house price growth.

Savills 5 year House Price Predictions (November 2022)

This continues from the Savills November 2022 forecast of a 10% fall in the average UK house price in 2024, with return to peak in 2026 as affordability pressures ease. However, this forecast is based on the Bank Of England base rate falling to 3.5% by year end 2024 and falling to 1.75% by 2026. With GDP growth fluctuating between +1.6% and +2.7%.

Savill’s November 2023 house price predictions are also predicated on the basis of Bank of England rate cuts in the second half of 2024. Savills outline that house price will fall -3% in 2024 but these rate cuts will provide “more capacity for growth”.

The problem with both house price forecasts is that there is no evidence the BOE will cut the base rate. At its meeting ending on 20 September 2023, the MPC voted by a majority of 5–4 to maintain Bank Rate at 5.25%. Four members preferred to increase Bank Rate by 0.25 percentage points, to 5.5%.

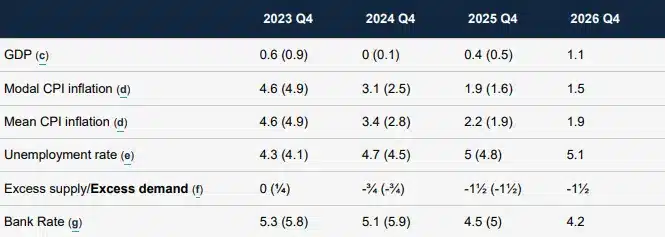

At this point in time, the Bank Of England is more likely to increase the rate than cut there rate. Showing no indicating that rates will decrease to 3.5% by the end of 2024. As the MPC would have to vote for consecutive rate cuts of 0.25 to 0.5. In the November 2023 Monetary Policy Report, the BOE forecasted the base rate would only drop to 4.2 by Q4 of 2026.

JLL House 5 Year House Price Predictions (November 2023)

JLL forecast that UK house prices are forecast to end the year down -6% (2023), with the latest JLL five-year forecast leaving the UK outlook for 2023 unchanged. They anticipate a bottoming out of prices in mid-2024 but falls earlier in the year are expected to outweigh any second-half increases. According to JLL this would result in single-digit (-3%) annual falls by the end of 2024.

JLL forecast that “in nominal terms prices at the end of 2024 are expected to be 12.7% down on their mid-year 2022 peak. But adjusting for inflation shows a fall of more than -20%.” JLL Residential Forecasts 2024-2028 forecasts that growth for 2025 and beyond as more competitive fixed rates deals enter the market. Cumulatively JLL forecast house price growth of 14% across the UK between 2024 and 2028. With higher growth of 16.30% in Greater London and 19.80% in Central London. This average per annum growth of 2.8% for the UK and 3.10% to 3.7% for Greater and Central London.

The JLL research cites “economic factors, supply-side challenges, and potential political events are expected to influence the trajectory. Consequently, real wages, a significant predictor of house prices, are expected to land between 0.7% and 1.5%. These assumptions, however, are notably optimistic. It is crucial to critically examine these statistical assumptions, as these underpin the 5 year house price predictions.

JLL 5 Year House Price Predictions For 2022 – 2026 (November 2021)

JLL’s earlier 5 year prediction for house prices also assumes the base rate is set to plateau until mid-2024, before starting to fall later in the year. Therefore, the 5 year forecast could prove entirely inaccurate, should the base rate fall no further than it’s long running average (3.8%). While their GDP growth projections are more conservative than Savills’, forecasting a 4.4% annual rate in 2024 and ranging from 2.2% to 2.9% between 2025 and 2028. They maintain an optimistic outlook by assuming inflation will dip below the Bank of England’s 2% target.

In JLL’s prior 5-year house price forecast from 2021, the assumption was a base rate of 3.75% in 2023, peaking at 4% in 2024. This is notably incorrect and overly optimistic with the actual base rate being 4.85% higher . Therefore, the house price forecast is likely incorrect and optimistic. At the time of this forecast we knew full what the impact of the Covid-19 economic stimulus would be on inflation. As the link between monetary supply and inflation is well documented. Therefore, I struggle to see how a 0.4% bank rate would be realistic.

Lloyds House Price Predictions For 2024 to 2026

The Guardian recently reported that both Lloyds and Santander are forecasting house price falls until 2025. Lloyds Banking Group has forecast that by the end of 2023 house prices would have fallen 5% over the course of the year. With further decreases of 2.4% in forecast for 2024. Santander is predicting a larger drop in UK house prices for the whole of 2023 of about 7%, followed by a smaller 2% fall in 2024.

Both lenders said the first signs of growth would start to emerge only in 2025. With Lloyds economists predicting a 2.3% increase in house prices that year and Santander expecting a 2% rise. In fact, Santander has seemed the most realistic this year with expectations of 10% house price falls in 2023. Which based on recent Land Registry data has already happened.

Read: Why A Complete Housing Price Crash In 2024 Is Now Inevitable

The Housing Supply Chain Shortage Myth

There is very little evidence of supply shortages or that the housing market is even close to peak pain. One Telegraph article explains that past estimates of housing shortages were based on overestimates of population grow. Recent census data show an increase in the surplus of dwellings, especially in London. The key issue affecting high house prices is not the insufficient number of houses but rather low-interest rates.

In fact, there is an increase in distressed sellers and landlords selling off their portfolios. This will reverse any notion of supply shortages. This is because interest rates have made the buy to let model unaffordable. Residential and landlords are coming off ultra-low fixed rates onto significantly higher interest rates. This is driving up arrears in the housing market. As a result, many selling up and moving to a cheaper home,as they struggle to cope with dramatically higher costs. There are over 1.5 million households which face this mortgage timebomb.

Higher Rates Will Bring More Supply To The Market

The real housing supply shortage is actually caused by the accumulation of property by small subset of the population. When I wrote about the approaching housing market crash in December 2022, landlords were buying up 1 in every 10 properties in the UK. 68% of these 2.74 million landlords are over the age of 55 and were using buy-to-let investments fund their retirement.

This same demographic face a £70,000 retirement portfolio shortfall. Falls in the stock and bond market will make this shortfall even worse and these landlords may need to cash out of properties to fund their retirement. Especially if there buy-to-lets are now unprofitable. This will bring a significant number of properties to the market.

Read: 5 Reasons House Prices Will Keep Falling In The UK

Read: The House Market Crash Is Much Worse Than It Seems Right Now

Conclusion: 5 Year House Price Predictions Are Looking Shakey

The house price forecasts from Savills and JLL rest on assumptions that raise concerns. These include the anticipation of a decline in inflation and interest rates, coupled with an optimistic projection of robust growth in GBP and real wages. The forecasts seemingly downplay potential economic challenges, and the high probability of recession and negative earnings growth. The frequently mentioned “supply chain shortages” are seemingly expected to withstand challenges of declining affordability and negative real wage growth. These supply chain shortages lack any kind of substantial evidence.

These house price predictions are very surprising. Based on the Bank Of England reports, interest rates will remain higher for longer. They will not fall as sharply as real estate agency forecasts hope. Certainly not in time to prevent a major market shift. Lastly, these 5 year house price forecasts hope for a miraculous recovery of the UK economy. Many would not be so optimistic and would argue for more prolonged house prices falls. With much deeper falls that these real estate house price predictions suggest.

Want to know more about house prices falls in England and Wales? Click here toreveal the map showcasing where house prices are fallingin your local area and stay ahead of the real estate trends with our exclusive insights!

Explore exclusive offers below. Limited time. Act now!

Take a moment to explore the offers below. These opportunities won’t stick around for long, so why not check them out?

Join me and invest with Freetrade. Get started with a free share worth £10 to £100. The probability is weighted, so more expensive shares will be rarer. T&Cs apply. Capital at risk.

Join me and invest with Wombat Invest. Get £10 in cash when you join Wombat with my exclusive affiliate link. Capital at risk.

Learn more about investing and get the 8 Index Funds that make my shortlist.

Open or transfer a SIPP with Moneyfarm to enter the £20,000 prize draw. Capital at risk.

Start investing with the Lightyear App and earn up to 4.50% interest earned on uninvested cash. Capital at risk.